Live your best life with a digital bank made for you. Enjoy bite-sized mobile investing, and cash and card-free living.

With OCBC Digital Banking, you're in your turf. Pay anyone, get personalised insights, invest and more when you want it, how you want it.

Set Savings Goals to automatically put money aside each month. Then get ready to check off your wishlist!

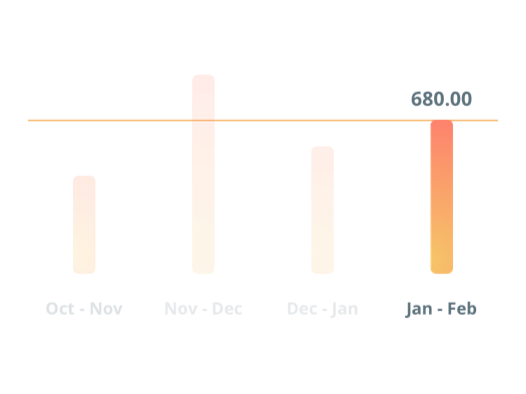

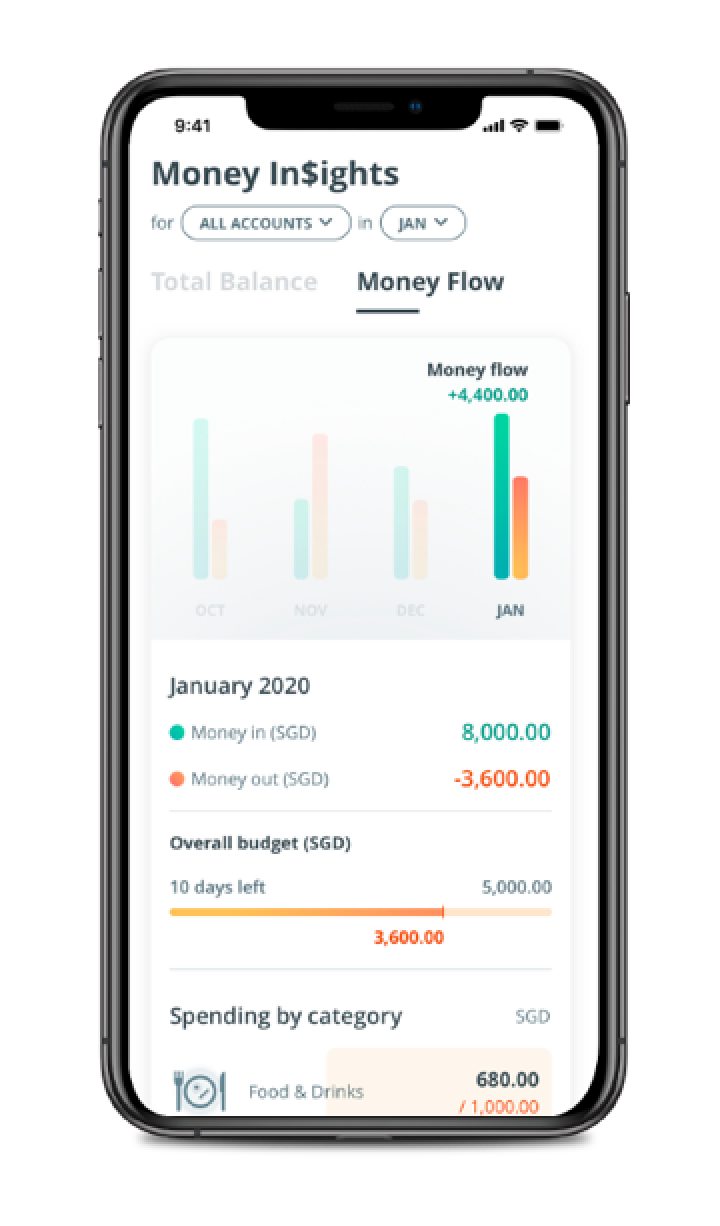

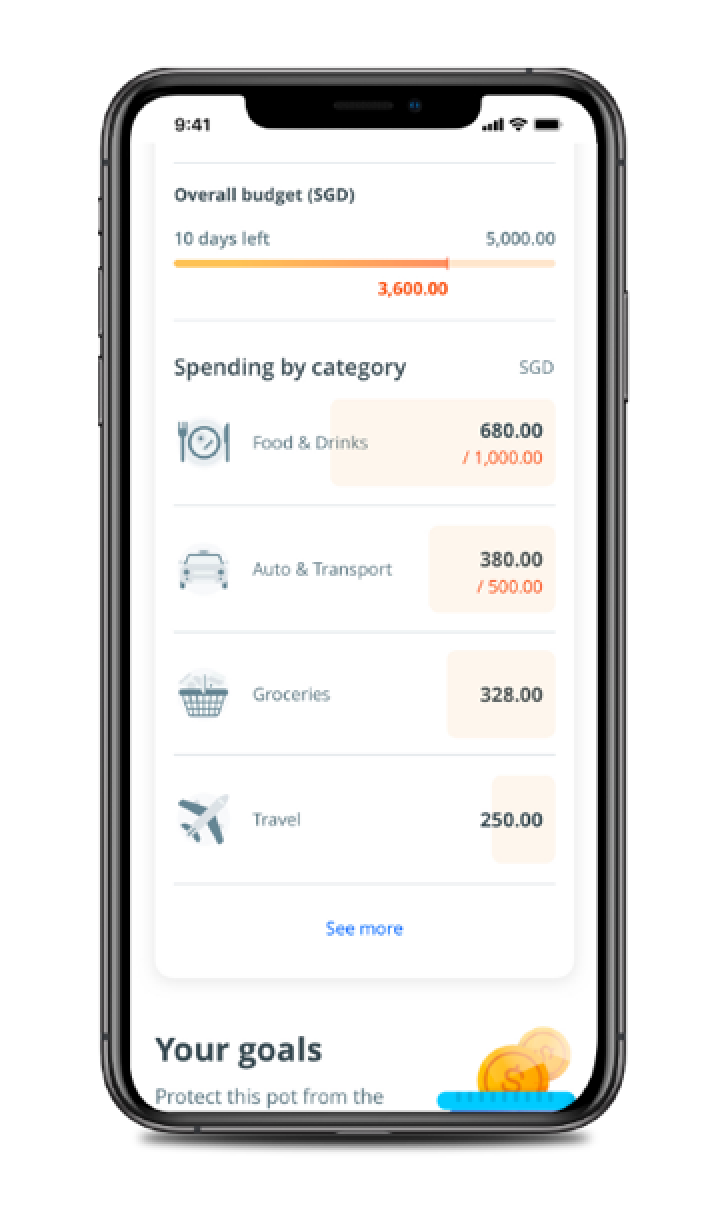

Track and categorise all your monthly spending with Money In$ights. You’ll know exactly where your money is going.

With Budgeting, you can plan for all parts of life so you won’t feel guilty at the end of each month.

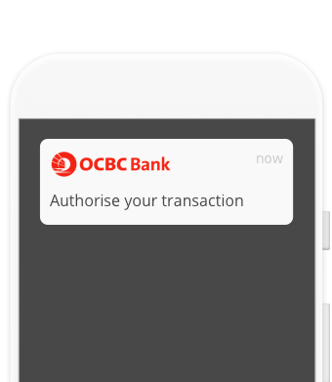

Bid goodbye to physical tokens or SMS OTPs. Simply activate OneToken on your mobile banking app. Learn more

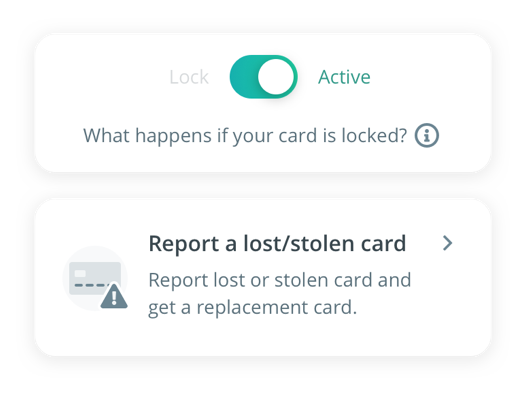

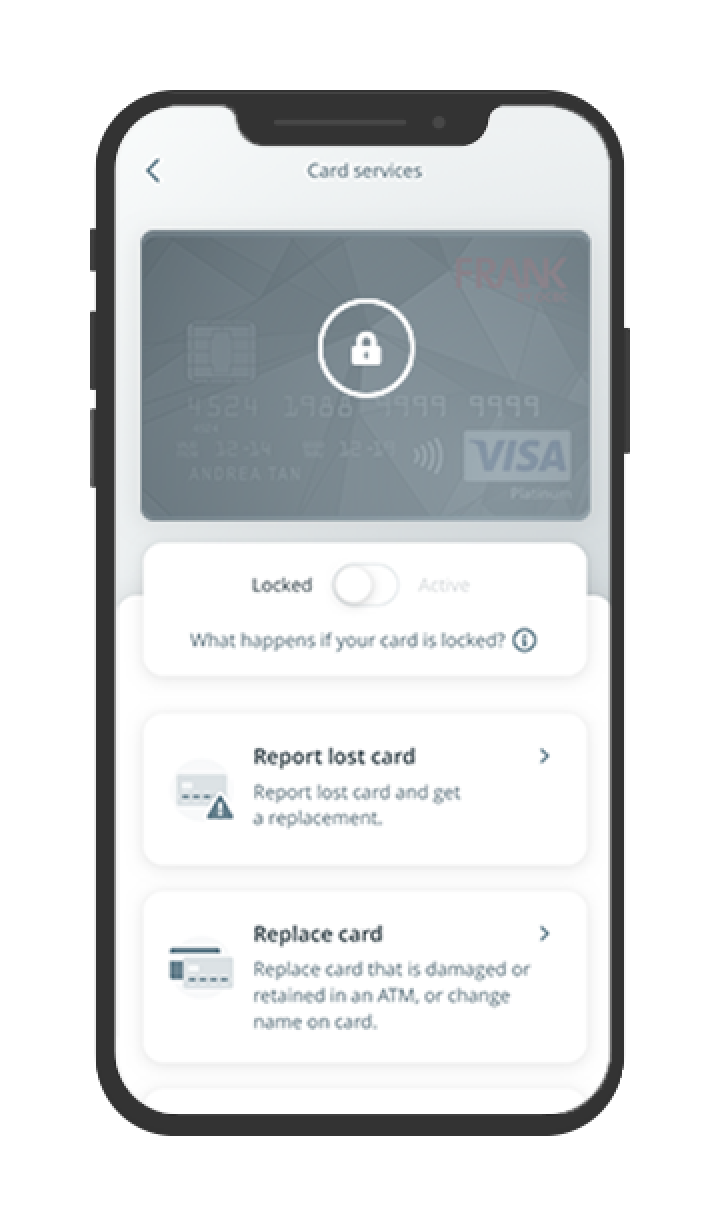

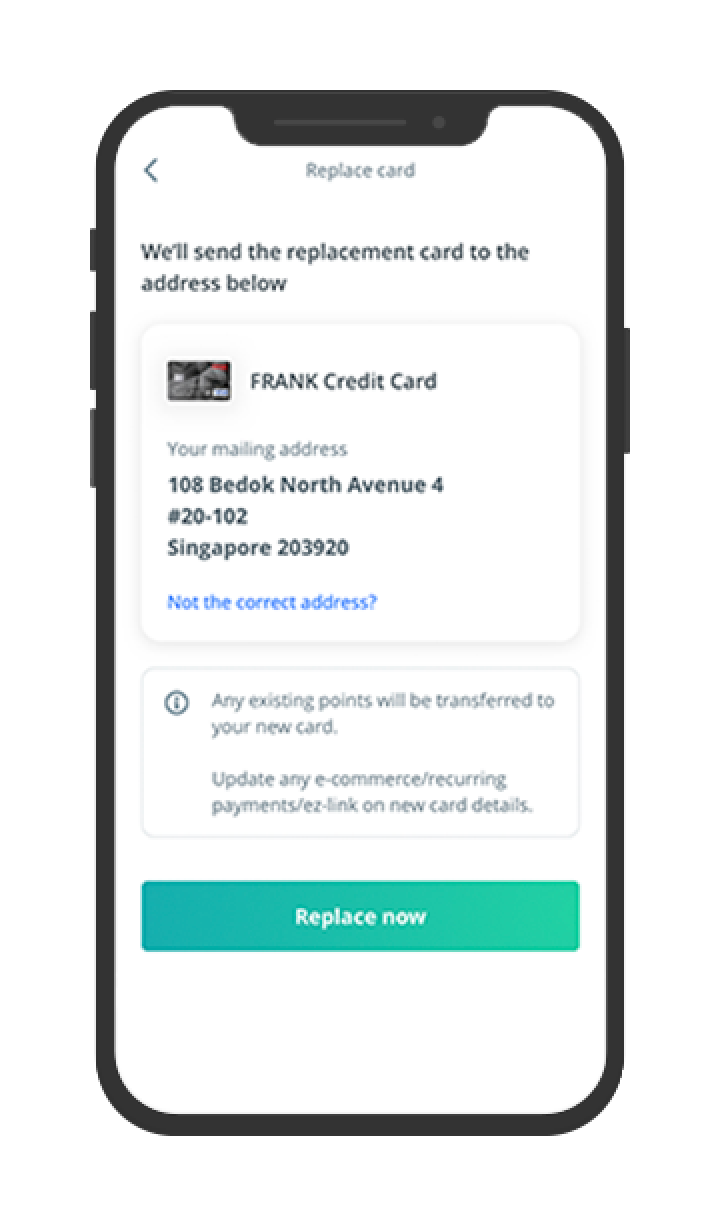

Lost or damaged card? Lock it, request for a new one or a replacement straight from the mobile banking app. Learn more

The app also lets you pay everyone with their mobile number. Plus, request payment from your friends by generating QR codes!

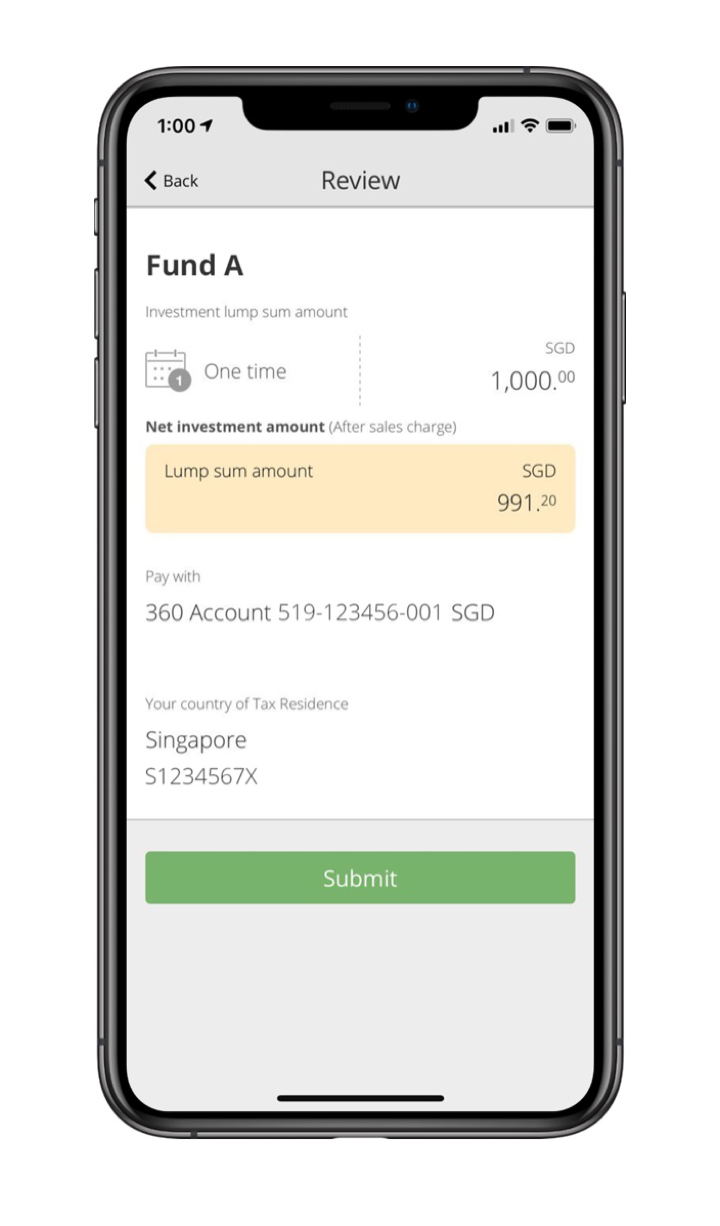

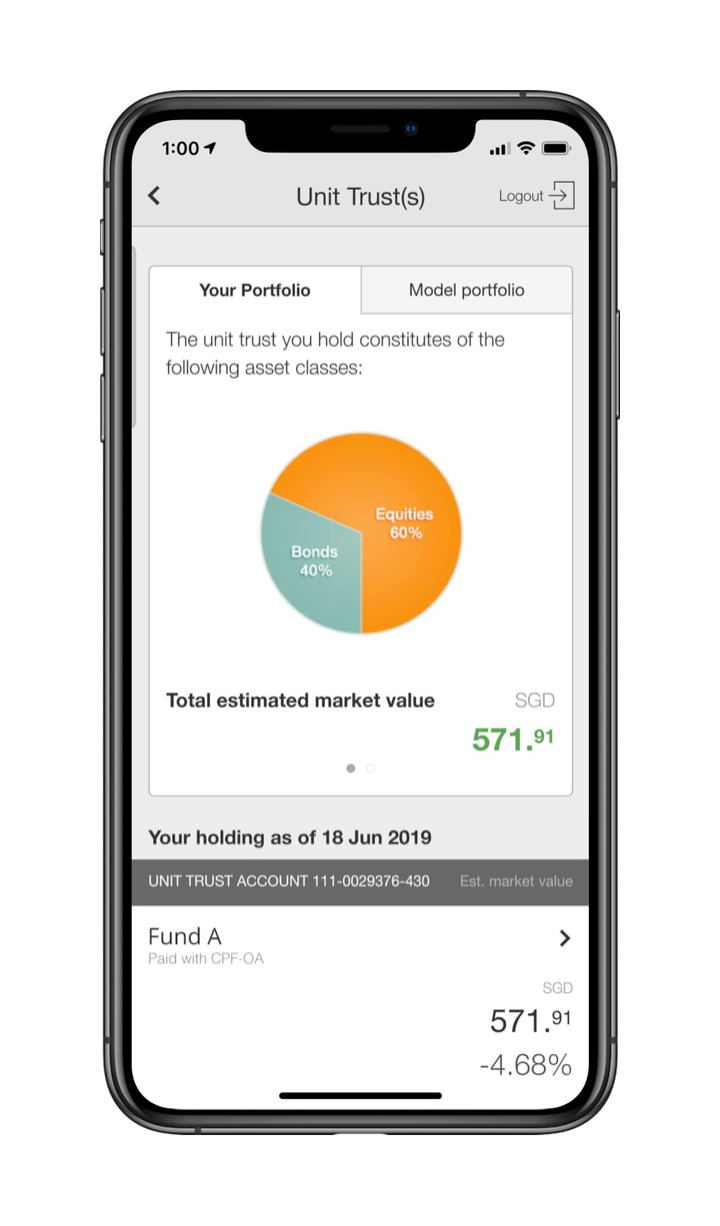

Build a diversified portfolio for any risk appetite. Buy and sell Unit Trusts, Singapore Government Securities and BCIP easily via the app.

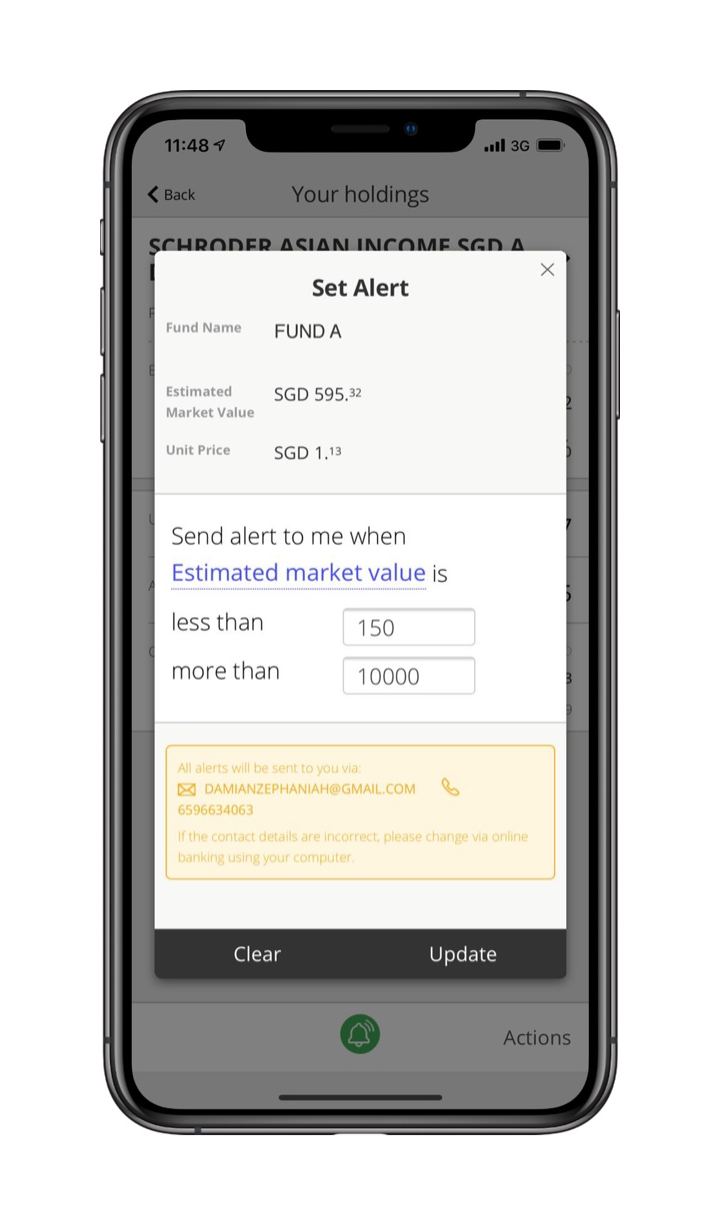

Set alerts on your app so that you never miss out on price fluctuations and market movements.

Monitor your portfolio, and gain access to investment ideas and thematic articles from OCBC investment experts from the app.

By mail

Collect and complete an online banking application form from any of our branches.

Mail it to:

Oversea-Chinese Banking Corporation Ltd

Account Services

Bras Basah Post Office

Locked Bag Service No. 8

Singapore 911886

At any of our branches

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries.

App Store is a service mark of Apple Inc., registered in the U.S. and other countries. Android, Google Pay and Google Play are trademarks of Google LLC.

Keep track of your spending automatically. Sit back and relax while we track and categorise your spending for you.

Set your budget* monthly, or by category. We'll alert you when you're close to exceeding your budget.

*Budget setting can only be done with OCBC Internet Banking on your desktop.

The OCBC OneToken replaces your hardware token, which means that transactions made on both OCBC Mobile Banking App and OCBC Internet Banking will use the OCBC OneToken service for authentication.

When you perform transactions like 'Add New Payee', OCBC OneToken will perform authentication in the background – making the whole process seamless and convenient.

When you perform transactions like 'Add New Payee', OCBC OneToken will perform authentication in the background – making the whole process seamless and convenient.

When you perform transactions on OCBC Internet Banking, you will now receive a push notification on your mobile phone that will prompt you to authorise the transaction. Simply tap on the notification and you're done!

When you perform transactions on OCBC Internet Banking, you will now receive a push notification on your mobile phone that will prompt you to authorise the transaction. Simply tap on the notification and you're done!

Lock your card to prevent any unauthorised transaction. If your card is found, you can unlock it anytime.

Still can't find it? Order a replacement card and well cancel your card and mail a new one to you right away.

Invest on the go using the OCBC Mobile Banking app.

Track and review your portfolio as and when you want to so you never miss out on market movements.

Set price alerts to monitor price fluctuations and market movements.

Access investment ideas, market updates and thematic articles from OCBC investment experts